Index Universal Life Insurance

Index Universal Life (IUL) insurance is a unique kind of life insurance that offers both protection for your loved ones and a growth opportunity for your savings. When you pay premiums, a portion can be allocated to a stock market index, like the S&P 500, allowing it to grow. While your money isn't directly in the stock market, insurers typically offer a growth cap, often between 8-9%, and ensure a floor of 0%. This structure means you can benefit from the market's upside potential while having protection against major downturns. Plus, the growth within the IUL is tax-efficient, adding another layer of benefit. In essence, with IUL, you get a safety net for your family, a chance for your savings to grow, and tax advantages all in one package.

Receive coverage for life that offers protection for you and your family in many different situations.

Protect your initial investment while still enjoying consistent growth each year. Your growth is set within a specific range, usually capped at 9% and never dropping below 0%, based on the performance of an index, such as the S&P 500.

You can potentially build wealth with tax benefits by putting your premiums into assets of your choice.

Index Universal Life Insurance

Index Universal Life (IUL) insurance is a unique kind of life insurance that offers both protection for your loved ones and a growth opportunity for your savings. When you pay premiums, a portion can be allocated to a stock market index, like the S&P 500, allowing it to grow. While your money isn't directly in the stock market, insurers typically offer a growth cap, often between 8-9%, and ensure a floor of 0%.

This structure means you can benefit from the market's upside potential while having protection against major downturns. Plus, the growth within the IUL is tax-efficient, adding another layer of benefit. In essence, with IUL, you get a safety net for your family, a chance for your savings to grow, and tax advantages all in one package.

Receive coverage for life that offers protection for you and your family in many different situations.

Protect your initial investment while still enjoying consistent growth each year. Your growth is set within a specific range, usually capped at 9% and never dropping below 0%, based on the performance of an index, such as the S&P 500.

You can potentially build wealth with tax benefits by putting your premiums into assets of your choice.

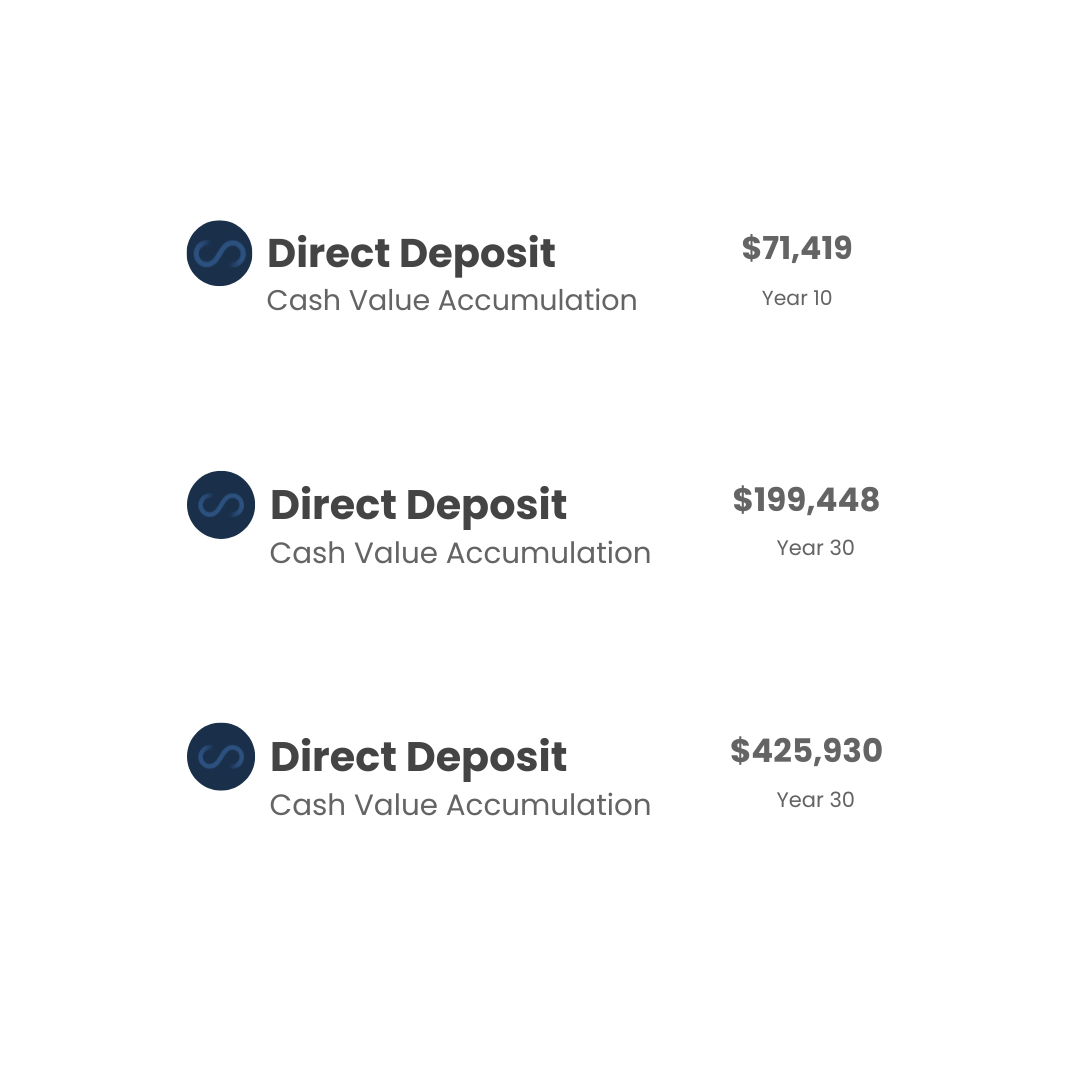

IUL EXAMPLE

Based on a Female, 34, Non smoker.

Paying $500 monthly premium. Prices Vary.

- $50,000 - $450,000 Coverage are considered Simplified Issued, which means does not require Blood/Urine sampling.

- $500,00 + Coverage are considered fully underwritten and will require Blood/Urine sampling.

-

Great product for investing into long term retirement with early borrow and no penalty vs. 401k or IRA.

- Unlike term life insurance, which has a set duration (e.g., 20 or 30 years), IUL is a form of permanent life insurance. This means it's designed to last your entire life, as long as premiums are paid.

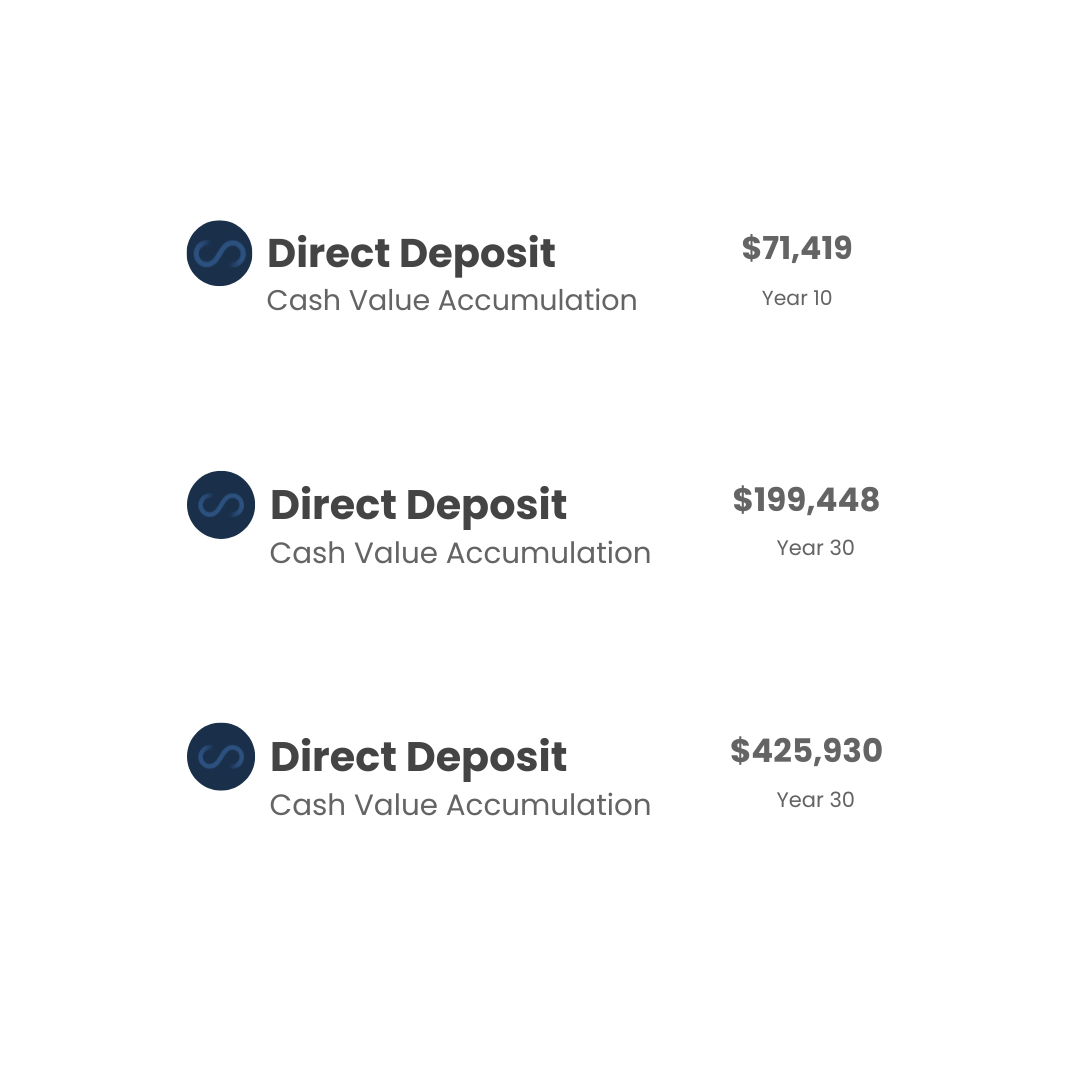

IUL EXAMPLE

Based on a Female, 34, Non smoker.

Paying $500 monthly premium. Prices Vary.

- $50,000 - $450,000 Coverage are considered Simplified Issued, which means does not require Blood/Urine sampling.

- $500,00 + Coverage are considered fully underwritten and will require Blood/Urine sampling.

-

Great product for investing into long term retirement with early borrow and no penalty vs. 401k or IRA.

- Unlike term life insurance, which has a set duration (e.g., 20 or 30 years), IUL is a form of permanent life insurance. This means it's designed to last your entire life, as long as premiums are paid.

Who is Index Universal Life Insurance for?

IUL insurance is a two-in-one deal. It's life insurance that will help your family if something happens to you. Plus, it's like a savings jar that grows over time. This growth is tied to the stock market, but you won't lose big even if the market goes down. You can also adjust how much you pay based on your budget. If you're thinking about extra money for retirement without selling your stocks or touching your home's value, IUL is a good choice. It lets your money grow in a predictable way and gives you protection for your whole life.

Who is Index Universal Life Insurance for?

IUL insurance is a two-in-one deal. It's life insurance that will help your family if something happens to you. Plus, it's like a savings jar that grows over time. This growth is tied to the stock market, but you won't lose big even if the market goes down. You can also adjust how much you pay based on your budget.

If you're thinking about extra money for retirement without selling your stocks or touching your home's value, IUL is a good choice. It lets your money grow in a predictable way and gives you protection for your whole life.

Questions?

We have answers

Index Universal Life (IUL) insurance offers several advantages:

-

Potential for Higher Returns: IUL policies allow the cash value to grow based on the performance of a stock market index, like the S&P 500. This can lead to higher returns compared to traditional universal life policies with a fixed interest rate.

-

Downside Protection: Most IULs have a guaranteed minimum interest rate, ensuring that even if the stock market performs poorly, your cash value won't decrease below a certain level.

-

Flexibility: IUL policies typically offer flexibility in premium payments, death benefits, and savings growth strategies. You can adjust these based on your financial situation and goals.

-

Tax Benefits: The growth within the cash value of an IUL policy is tax-deferred, meaning you don't pay taxes on the growth until you withdraw the money. Additionally, death benefits are generally tax-free for beneficiaries.

-

Loan Options: You can borrow money from the cash value of your IUL policy, often at a low interest rate. This can provide liquidity without incurring penalties or taxes.

-

Long-Term Growth: IULs can be a good vehicle for long-term financial planning, offering a combination of life insurance protection and potential for cash value growth.

-

No Direct Market Risk: While the cash value growth is linked to a stock market index, the money isn't directly invested in the stock market. This means there's no risk of losing the principal amount due to market downturns.

Considering Universal Life Insurance as part of your insurance plan can be beneficial in several scenarios:

-

Long-Term Financial Planning: If you're looking for a combination of life insurance and a savings or investment component that can grow over time, Universal Life Insurance might be a fit.

-

Flexible Premiums: If you anticipate fluctuations in your ability to pay premiums and want the flexibility to adjust them based on your financial situation, Universal Life allows for such adjustments.

-

Lifetime Coverage: Unlike term insurance, which covers you for a specific period, Universal Life provides coverage for your entire life, making it suitable if you want lifelong protection.

-

Tax-Advantaged Growth: If you're seeking ways to grow money in a tax-deferred manner, the cash value component of Universal Life offers this benefit.

-

Estate Planning: For those with significant assets, Universal Life can be a tool for estate planning, helping to cover potential estate taxes and ensuring a financial legacy for heirs.

-

Supplemental Retirement Income: If you're looking for additional sources of income in retirement, the cash value from a Universal Life policy can be accessed through loans or withdrawals.

-

Business Planning: Business owners might use Universal Life for key person insurance, buy-sell agreements, or other business continuity strategies.

Combining protection, like insurance, with growth, like investments, in one package has its perks. It makes managing your finances simpler because you're dealing with one product instead of many. Often, you can save money because these combined packages might offer better rates or fewer fees. This approach ensures you're looking at your finances in a well-rounded way: you're safe from unexpected events while also planning for the future. Plus, these bundled products are usually more flexible. For example, with some life insurance plans, you can change the coverage amount and decide how you want the savings part to grow. If you ever need money, some of these products let you take out a part of your savings. They might also offer tax breaks, like not paying taxes on the growth until you take money out. Regularly putting money into these products can help you stick to a savings habit. Overall, having both protection and growth in one place gives you peace of mind, knowing you're set for now and the future.

Questions about our plans?

Call us Monday - Friday 9am - 6pm EST

For Life Insurance Services, 1-888-538-3288

For Health Insurance Services, 1-888-533-3558

Questions about our plans?

Call us Monday - Friday 9am - 6pm EST

For Life Insurance Services, 1-888-538-3288

For Health Insurance Services, 1-888-533-3558

Questions about our plans?

Call us Monday - Friday 9am - 6pm EST

For Life Insurance Services, 1-888-538-3288

For Health Insurance Services, 1-888-533-3558